Search money saving tips when we live a migration process is not born out of abundance, but out of the need to sustain ourselves.

Saving, in this context, is not a luxury or an abstract goal: it is a concrete tool to gain stability, reduce uncertainty and protect the dreams that brought us here.

We often associate saving with depriving ourselves of everything, with living in standby mode. But when we migrate, saving has another meaning. It is to anticipate the unexpected, it is to give us a margin to decide more calmly, it is to build a small cushion that allows us to breathe when something gets complicated.

In this article we share practical tips to save money without losing sight of what is most important: continue to move forward. Because taking care of our finance is also a form of taking care of ourselves and to the life project we are building far from home.

Understanding where our money goes: the first step to saving with intention

Before applying any list of money saving tips, we need something basic: to look straight ahead our actual costs.

Not the ideals, not the ones we think we have, but the ones we actually have. are released every month. When we migrate, money tends to be dispersed in small day-to-day payments that, without realizing it, accumulate.

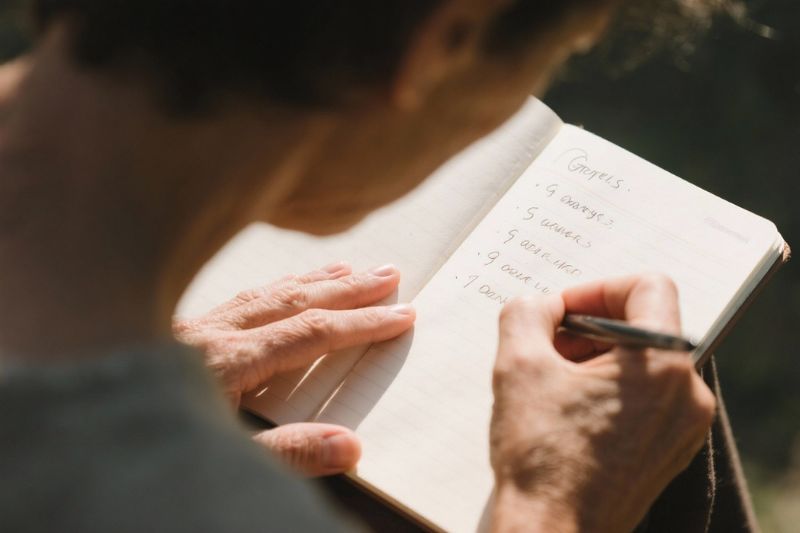

Carry a simple expense record, in a notebook, an app or a note on the phone, helps us to identify patterns.

Transportation, eating out, subscriptions, small “just because” purchases. It is not about judging us, but of understand how our money moves.

Often, saving does not start with eliminating large expenses, but rather with fine-tuning details that were not aligned with our current priorities.

Looking at the big picture, we can decide more clearly which expenses are necessary now and which can wait.

This first step does not save money by itself, but it does save money. gives us back control. And in a migratory process, control is a form of stability.

Separating the essential from the urgent: saving without giving up on life

One of the money saving tips more useful in a migration context is to learn to differentiate the essential from the urgent.

Not everything we need right now is essential in the long term, and understanding that difference helps us make better decisions.

Lo essential is usually clear: housing, food, basic transportation, health and necessary paperwork. Lo ... urgent, Instead, it often appears as an emotional response: to spend, to feel relief, to compensate for tiredness or to fit into a new environment.

Saving does not mean eliminating all enjoyment, but set conscious limits. We can allow ourselves small tastes, as long as they do not compromise what we are building. Choosing with intention is different from being prohibited.

When we learn to prioritize, saving ceases to feel like punishment and begins to be seen as a tool that takes care of us. Because sustaining our migratory dreams also implies knowing when to say “not now” to be able to say “yes” further on.

Setting small, realistic goals: savings that do stick

Another of the money saving tips that work best when we migrate is to stop thinking only in big numbers and start thinking in terms of the set small, achievable goals. Saving does not have to be all or nothing.

In fact, when we try to do it this way, it is usually short-lived.

Setting ourselves clear objectives makes savings more effective. more consistent and less frustrating. It can be setting aside a fixed amount each week, saving what is left over at the end of the month or allocating a small percentage of each income. The important thing is not how much, but the regularity.

These goals serve another key function: give us back a sense of advancement. Every time we manage to accomplish them, we confirm that we are building something, even in difficult months. In a migration process, that sense of progress is as relevant as the money itself.

Saving in this way also allows us to adjust without guilt. If one month we don't make it, we review and continue. The savings that is sustained is not the perfect one, but the one that adapts to our reality and accompanies us along the way.

Sending remittances without neglecting ourselves: helping also requires balance

For many migrant peoples, saving is directly related to the sending money home.

The remittances are not just another expense: they are an emotional and family commitment and, many times, a constant responsibility. For this reason, one of the money saving tips most important is integrating remittances into our financial plan, not treat them as something separate.

Sending money should not mean running out of margin. Helping does not mean leaving ourselves unprotected. When we plan how much we can realistically send, we avoid the financial and emotional drain that comes when we give more than we can sustain.

A good practice is to define a fixed amount or a percentage, instead of sending varying amounts each time. This brings clarity to both the sender and the receiver, and allows savings and remittances to be sent at the same time. coexist without conflict.

It is also important to review how and when we ship. Choosing reliable channels, comparing costs and taking advantage of tools designed for regular shipment helps to ensure that more money reaches its destination without affecting our stability.

Taking care of our finances while caring for our own is not selfishness. It is understanding that we can only sustain in the long term that which also sustains us..

Creating a backup fund: peace of mind for the unexpected

One of the money saving tips that has the greatest impact on migratory life is to build a backing fund, even if it is small.

We are not talking about large amounts, but about a basic cushion that allows us to react when something does not go as planned.

Living in another country means facing contingenciesA medical expense, a job change, an urgent procedure or an unexpected relocation. Having a fund, however modest it may be, gives us the ability to room for maneuver and reduces anxiety in situations over which we have no control.

This fund does not have to be built up all at once. It can grow little by little, with regular and realistic contributions. Perseverance makes possible what seems distant. Even separating a minimal amount automatically helps the habit to be maintained without extra effort.

Beyond the money, this fund represents something important: emotional security. Knowing that we have a backup allows us to make decisions more calmly and sustain our migration plans without feeling that everything depends on the next income.

Learning to say no: saving is also an emotional decision

One of the money saving tips less mentioned, but most necessary in the migratory experience, is learning how to setting limits without guilt.

We don't always spend out of necessity: many times we spend out of commitment, for social pressure or for not wanting to be left out.

Saying no to certain plans, purchases or invitations does not make us less grateful or less integrated. On the contrary, allows us to take care of our process.

Saving implies recognizing that not all other people's rhythms are compatible with our current reality.

At migratory contexts, It is common to feel the need to show that “we are well”. To go out more, to spend more, to appear stable before having it. But stability is not proven: it is built. And part of this construction is to choose honestly what we can assume and what we cannot.

Learning to say no is uncomfortable at first, but it liberates. It restores consistency between what we want to achieve and how we use our resources. And when spending stops being automatic, saving appears as a natural consequence.

Taking care of our migratory dreams also involves protect them from impulsive decisions. Sometimes, the most responsible act is not to spend to fit in, but rather to save to advance.

Thinking of savings as a process, not as a passing phase

Another of the money saving tips what makes the difference is to stop seeing savings as something temporary, something we do “in the meantime”, and to start understanding it as part of the migration process. Saving is not a phase prior to living better; it is a tool that accompanies us as we move forward.

When we assume that our situation will change, we also understand that our way of saving must evolve. What is a big effort today may be an integrated habit tomorrow. Thinking this way avoids frustrations and unnecessary comparisons.

Organizing savings with a medium-term outlook helps us to make more strategic decisions. It is not only about saving money, but also about knowing what for: to regularize papers, to get training, to move, to start a business or simply to gain peace of mind. Having a clear purpose makes the effort make sense.

Saving as a process also implies flexibility.

There will be better months and tighter months. Do not give up the habit in difficult times is what allows savings to really sustain our migratory dreams.

Because moving forward is not always going faster. Sometimes, moving forward is continue steadily, even when the road moves.

Saving is also a way to support ourselves

Apply money saving tips in a migration process is not just about numbers, accounts or sacrifices. It is about give us time, leeway and stability on a path that is already demanding in itself. Saving is a concrete way to take care of ourselves when everything around us changes.

Every conscious decision - tracking expenses, prioritizing, sending remittances with balance, building support, setting limits - builds something bigger than a number. It builds peace of mind, autonomy y ability to choose. And that, when we live far from home, is worth a lot.

Not every month will be the same. Not all efforts will be noticed immediately. But consistent savings, however small, become a solid foundation on which we can continue to build our projects.

At Curiara, We know that migrating implies supporting many things at the same time: those we leave behind, what we are building here and what we dream of for the future. Saving is not giving up living, it is protect the road we are traveling through.

Every step counts. Every conscious decision adds up.

Because when we take care of our resources, we also take care of our dreams.

Curiara: accompanying processes that are built with effort and perseverance.