Caring does not always show. Sometimes caring is also about understanding how to protect what we earn so that it reaches those we love the most. The double taxation treaty is one of those silent tools that helps us, as migrants, to take better care of our money and thus take better care of our own. Because migrate is not just about sending: is to sustain, plan and protect from afar.

Those of us who live and work far away from our country know that every coin we send carries a little piece of us, a little bit of ourselves. gesture of love and commitment. But this gesture may be affected by taxes levied in two different places.

Understanding how the double taxation treaties allows us to avoid paying twice for the same thing and to keep alive the purpose of each shipment: to feed, educate, accompany and care.

At Curiara We believe that caring is also about being informed. That protecting what we send is another way to be present, to continue to sustain with dignity and to ensure that today's efforts are transformed into a shared future tomorrow.

What is a double taxation treaty?

The double taxation treaty is an agreement between two countries which aims to prevent the same person from paying tax twice on the same income. This happens, for example, when someone works in a country other than their home country and their income could be taxed in both places.

These treaties determine in which country certain taxes are to be paid, such as those related to salaries, pensions, investments o professional activities, and which ones can be exempted. This ensures fairer and more transparent treatment for those generating revenue in international contexts.

In simple terms, a double taxation treaty protects those of us who live or work outside our own country, ensuring that our efforts are not duplicated by unnecessary tax burdens. It is a way of recognising that behind every income there is work, planning and purpose.

In addition, these agreements facilitate economic flows between countries, encourage investment and bring stability to those of us with financial or family ties in more than one territory.

In practice, they offer a breathing space: they allow hard-earned money to be spent on what really matters - the well-being, future and peace of mind of those on both sides of the road.

Why this procedure is so important to you

For many migrants, Working in another country is not just a financial decision: it is a way of continuing to support those we love, even if we are far away. Every income counts, and every transfer carries behind it a effort which should not be affected by a double tax burden.

For this reason, the double taxation treaties are especially relevant for those of us who live between two realities: that of the country that welcomes us and that of the home that still awaits us.

Thanks to these agreements, the migrants we are able to meet our tax obligations without paying twice for the same income. This means more clarity, less financial stress and greater stability to plan for the future with certainty.

When a country recognises the contribution of those who we work outside and prevent our income from being taxed twice, it is also recognising its role in the economy and in the company. It is a way of giving value to those efforts which sustain families, projects and communities entire communities across borders.

This procedure, although technical, is an example of how care can be translated into concrete actions, into decisions that make every international transfer tell us more.

How to find out if we can benefit from this agreement

“I've been in Spain for a year and I still find it hard to understand taxes. I just want to get it right and not pay twice for the same thing”.”

We who are starting a new stage, who work and make accounts to meet here and help there, to know if we can benefit from a double taxation treaty can make the difference between worrying and planning ahead.

The first thing is to know our tax residence and check if there is a treaty in force between Spain and the country where we earned our income.

This information can be easily consulted in the electronic headquarters of the Tax Agency (AEAT) or with a specialised tax advisor.

If you have just arrived in Spain, There are also solutions and accounts designed for new residents that facilitate the process and help us to regulate our situation from the outset.

Steps to avoid paying tax twice

- Check our tax residence: residence determines where we are taxed on our worldwide income. It is the starting point for the correct application of treaties.

- Identify whether there is an applicable convention: We can check it on the AEAT website or consult a professional who can guide us according to our country of origin.

- Apply the relevant procedure: depending on our case, it can be a exemptiona deduction or the application for refund of withholding tax.

- Retain supporting documentation: we must keep withholding certificates and tax returns. They are essential to avoid any inconvenience with the tax authorities.

Examples of countries with double taxation treaties

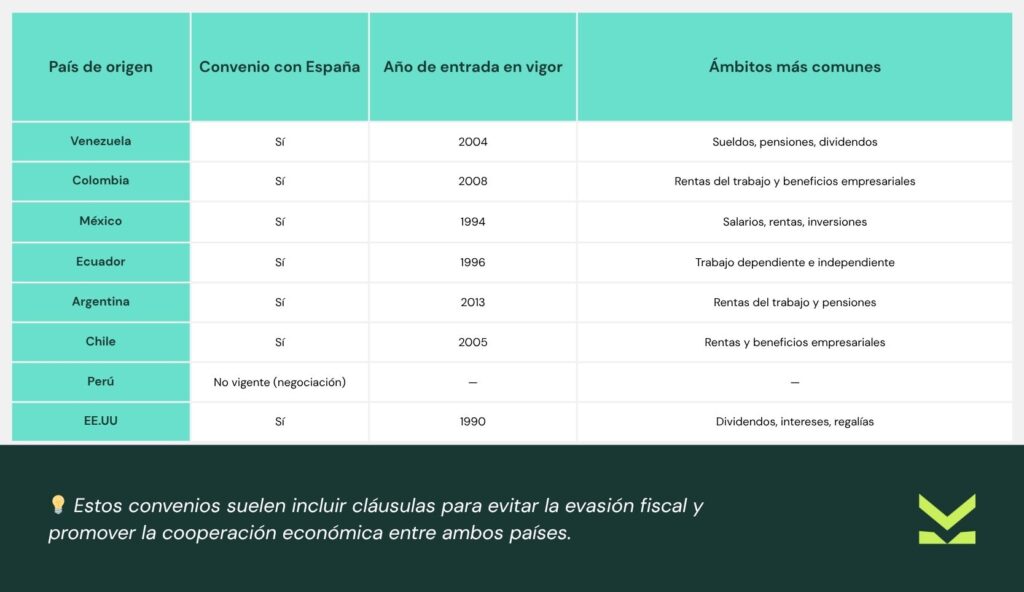

Spain maintains agreements in force with more than 90 countries, many of them regular destinations or places of origin for the migrant community.

These treaties ensure that income generated abroad is not taxed twice. They also provide for which country has the right to levy which tax and how exemptions or deductions can be applied.

Each agreement has its own conditions, so it is important to always check for the most up-to-date version and, if possible, have vocational guidance.

To find out if our country has an agreement in force with Spain can help us to plan more clearly, meet our obligations without overpaying, and protect our hard-earned income..

Because understanding how these work agreements It not only saves us money: it also gives us stability, allows us to plan for the future and brings us a little closer to that peace of mind we all seek on the other side of the ocean.

Real benefits for the migrant community

We, who support from afar, know what each income costs. That is why the double taxation treaties are not simply fiscal arrangements: they represent a form of recognition for those of us who work, send and build across borders.

These treaties offer concrete benefits that directly impact our stability and that of our families.

More justice, less burden

They prevent let's pay taxes for the same income in two different countries. This not only balances our finance, but also reflect a basic principle of fairness: that our efforts should not be measured twice.

Greater fiscal clarity and peace of mind

To have a agreement in force gives us legal certainty. Do you know where we are taxed, what obligations we have and what we have to do? documents we need. And that clarity is also emotional well-being: less fear of making mistakes, more confidence to plan.

Protecting savings and the future

When we pay the right amount, we can spend more on our children and families. projects, our shipments or savings. The agreements encourage the investment, education and family stabilityThe pillars of a progress that is being built little by little, month by month.

Recognising those who live between two worlds

Each treaty is also a sign of institutional respect towards the migrants and their contributions. Recognises the role they play in the global economy and their commitment to deliver and contribute, even from afar.

A formality that is also an act of care

Taking care of money we send means recognising the value of our time, of our days, of every hour we spend away.

That is why protecting our income through the double taxation treaty is a sign of respect for ourselves and for those who receive our help.

Sometimes caring takes big gestures, sometimes it takes small but decisive steps. This paperwork is one of those gestures. A document that, beyond the paper, sustains a story of work and responsible love.

The double taxation treaty may seem like just a legal clause, but in real life it represents peace of mind. It gives us the possibility to live, send and save fairly.

It protects us from paying twice, from losing out due to ignorance, from having our efforts reduced due to a lack of information.

At Curiara We understand it as such: care we love is more than SEND MONEY. It is making sure that the money arrives in full, that nothing is lost along the way, that what we give with effort is converted into well-being.

Because taking care of the money we send is taking care of the future of those we love.