In the financial world of United Statesone of the most common, and at the same time most confusing, terms for many people is that of 'what is the ABA number?', one of the most common and at the same time the most confusing question for many people...

This code appears in checks, account statements and in the banking information requested for wire transfers or direct deposits.

However, it is not always clear how it works, what exactly it is used for and how it differs from other numbers such as the account number, routing number or the SWIFT code.

In this article, we will delve into all these aspects so that you have a complete and clear guide.

What is the ABA number?

The ABA number is a numeric code of nine digits created in 1910 by the American Bankers Association (hence its name).

Its main objective is to identify the financial institution in the United States that processes a bank transaction.

Simply put, it is a identifier only one that allows the systems financial know precisely at which bank a payment should be received or processed.

When someone wonders what is the ABA numberis actually talking about a identification system designed to ensure that the domestic transfers reach the right destination, no matter how many banks there are in the country.

Its role in the banking system

The raison d'être of this issue is avoid mistakes in the routing of payments. In a country like United StatesIn a country where there are thousands of banks and credit unions, it was essential to have a standard system that differentiated each institution.

The main functions of the ABA number include:

- Process domestic wire transfers (ACH and Wire): every time money is sent between accounts in different countries. banks in the U.S.the number ABA indicates to the system which institution should receive the payment order.

- Direct deposits: when a company deposits payroll for its employees, the number of ABA ensures that the funds go to the correct bank.

- Automatic payment of invoices: if you configure a automatic debit from your account to pay for services such as electricity or internet, your bank will use the ABA number to identify the receiving institution.

- Validation of transactions: serves as a filter to confirm that the transaction is performed within the U.S. banking system.

Understand what is the ABA number without this code, the companies would not have been able to banks would not be able to safely process the large quantity of electronic transactions that occur on a daily basis in USA. USA.

Difference with account number

One of the most common mistakes is to think that the ABA number is the same as the account number. In reality, they are completely different:

- ABA number: identifies the bank itself.

- Account number: identifies your personal or business account within that bank.

For example:

- The ABA number would be like the address of the bank's head office.

- The account number would be like the apartment number within a building.

Both are required to complete a transaction. If someone only has your account numberbut not the ABAshall not send money correctly because the system will not know to which bank to direct the operation.

In this way, understanding what is the ABA number and how it differs from the account number is key to avoid confusion when receiving payments or setting up transfers.

ABA number, routing number and SWIFT number:

Another point of confusion arises because the ABA number sometimes called "Routing Number. In fact, in practice, they are the same.

- ABA or Routing Number: is the nine-digit code used within the United States for domestic transfers.

- SWIFT or BIC number: is the international code that identifies banks globally. It is used in international transfers and usually consists of between 8 and 11 alphanumeric characters.

In conclusion:

- If you are sending money within United States: you need the ABA number.

- If you are sending money to or from another country: you will need the SWIFT number.

This explains why understanding what is the ABA number is essential to distinguish it from the SWIFTespecially if you receive payments from both national and international.

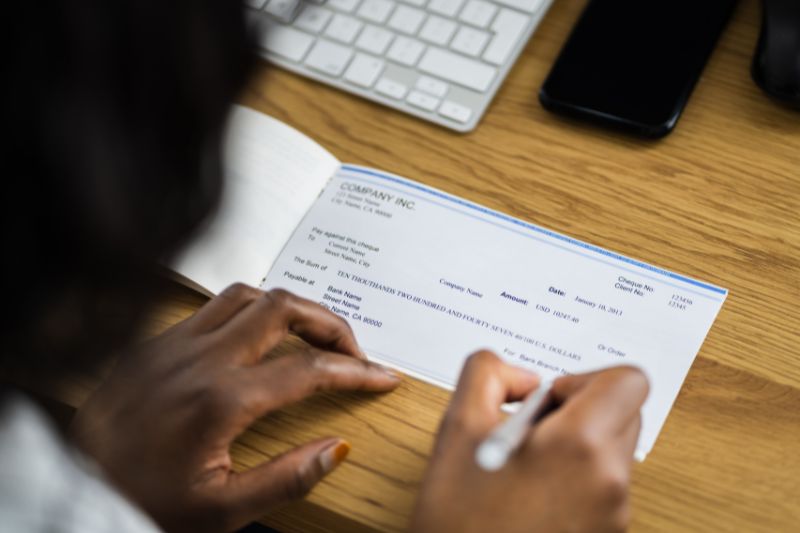

How to identify it on a check?

If you have ever had a U.S. check in your hands, you have probably seen a series of numbers printed on the bottom. There, the ABA number see at the far left, at the beginning of the digit linejust before the account number.

- The first nine digits correspond to the ABA number.

- Then, the account number appears.

- Finally, the check number is included.

In this way, any person can quickly identify which is the most important ABA of your bank.

Locate it in account statements:

In addition to the checksit is also possible to find the ABA number in:

- Printed or digital account statements: usually appears next to your account number and other relevant banking information.

- Online banking portal or mobile application: many banks show it in the "Transfer information". o "Wire/ACH Instructions".

- Bank customer service: In case of doubt, you can always apply directly to the financial institution.

Saber what is the ABA number and where to find it avoids delays in receiving funds or setting up an automatic deposit.

What happens if I use the wrong one?

The use of a ABA number The wrong one can cause the transfer:

- Be delayed.

- Be returned to the sender.

- Or, in the worst case, it is sent to the wrong bank.

For this reason, it is always advisable to verify what is the ABA number of your bank directly in official sources (online banking, checking or customer service).

Is it unique for each bank?

In most cases, yes, but with nuances. Some large banks have more than one ABA numberdepending on:

- The state or region where the account was opened.

- If the transaction will be ACH (standard transfer) or Wire (fast electronic transfer).

For example, a national bank may have one ABA number for California operations and a different one for New York operations.

Therefore, before send or receive moneyIf you have the correct ABA for your type of operation, it is vital to confirm which is the correct ABA for your type of operation.

A personal note from Venezuela

Like VenezuelansWe know how important it is to understand these terms when living abroad or when we need to send money to our families.

For us, every transfer represents more than a simple banking operation, it is a bridge of love, support and hope for those who are still in our country, our mothers in one of those beautiful beachesour grandmothers cooking...

Knowing what is the ABA number and how to use it correctly not only avoids errorsbut also ensures that that effort, every sacrificial dollar sent, gets into the right hands. which is

Because, in the end, beyond numbers and codes, what moves us is our heart and the desire to continue building a future inside and outside of our country. Venezuela.

In services such as Curiarawhere many Venezuelans we send remittances to our familiesthe ABA number is an essential piece of information. Knowing it and using it correctly helps us to ensure that each shipment arrives smoothly. And even though we are far away, we still carry our Venezuela in our souls.

Curiara, uniting families.